Norwalk Unclaimed Property Records

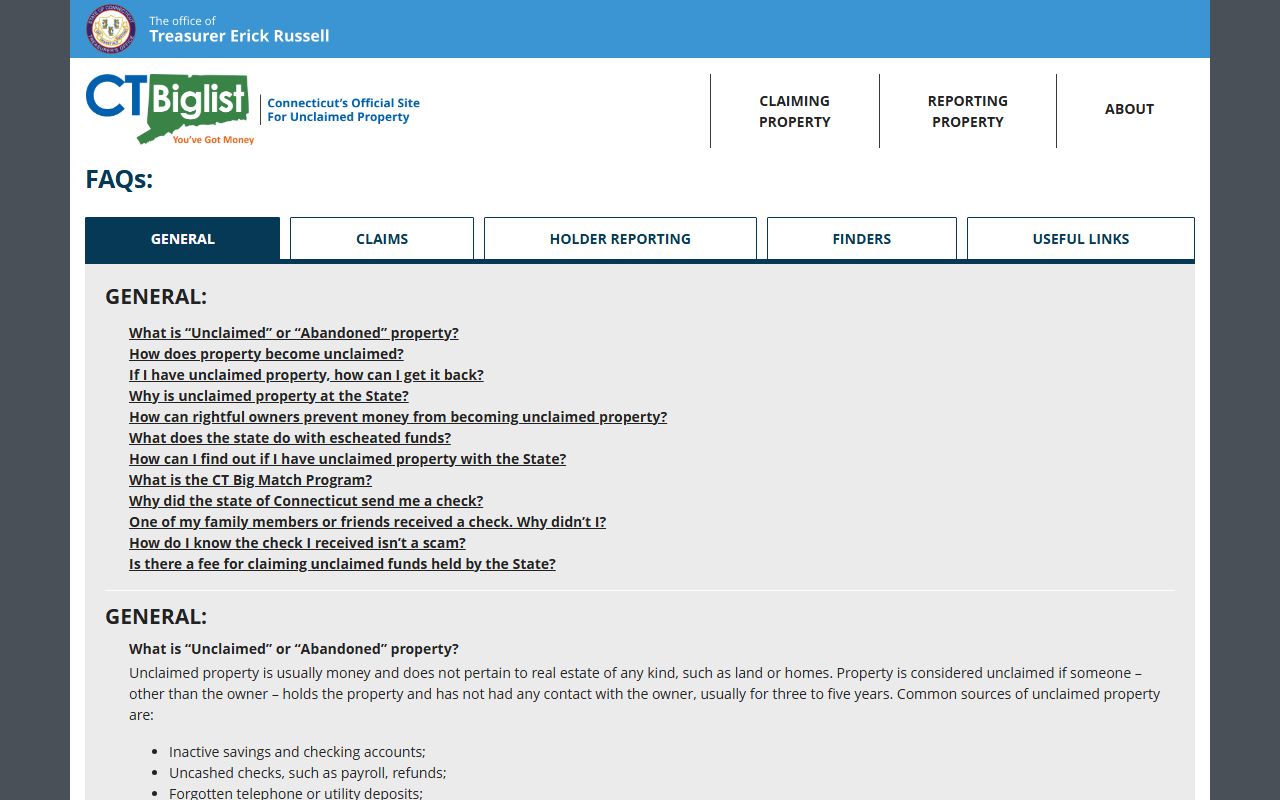

Norwalk residents can search for unclaimed money through the Connecticut Office of the State Treasurer. The state holds over one billion dollars in unclaimed funds for people across Connecticut. Norwalk has no local database for these records. All searches go through the official CT Big List at ctbiglist.gov. You can look up your name for free anytime. The database contains records from banks, insurance companies, and businesses that lost contact with their customers. Many people in Norwalk have funds waiting. You can claim what belongs to you at no cost. Call 1-800-833-7318 for help with your search.

Norwalk Quick Facts

Where to Search for Norwalk Unclaimed Money

The CT Big List is the official database for all unclaimed property in Connecticut. Norwalk residents can search this database at ctbiglist.gov. The site lists names of people and businesses with unclaimed funds. You can search by name or property ID. Results show owner names, last known addresses, and property types.

The Treasurer's office holds money from banks, insurance companies, and businesses. These holders report funds after no contact for three to five years. The state never takes ownership. Your money stays safe. You can claim it anytime. The service is free.

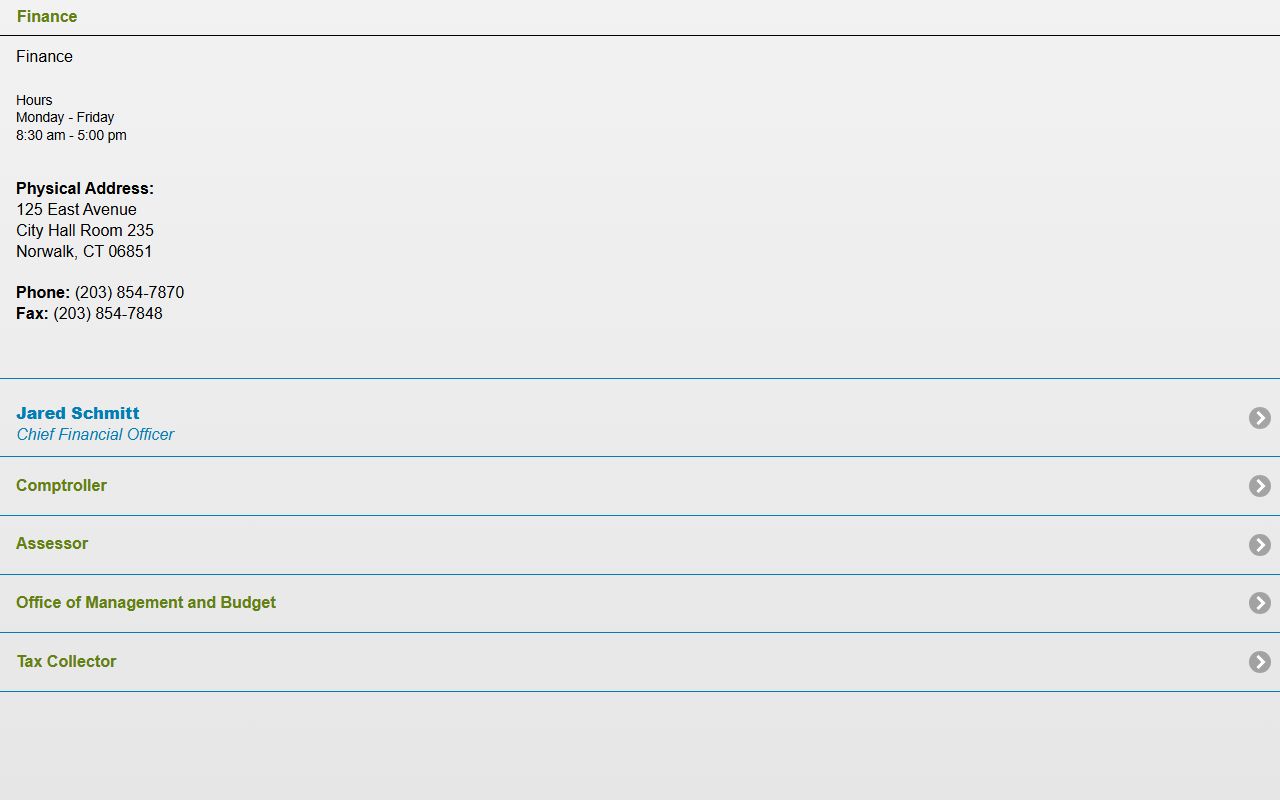

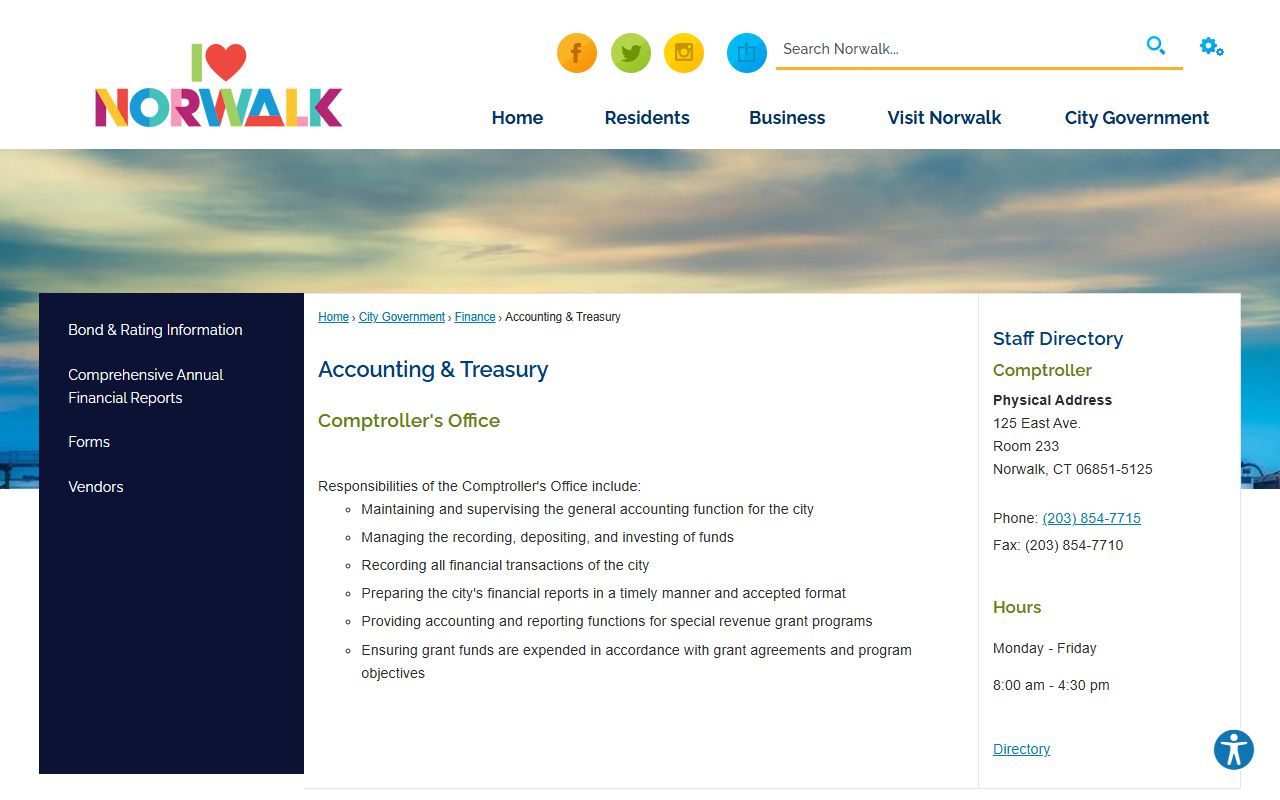

Norwalk City Hall can help with local questions. The Finance Department is at 125 East Avenue, Room 235. The Tax Collector is in Room 105 on the first floor. Hours are Monday through Friday, 8:30 am to 5:00 pm. The city website is norwalkct.gov.

What Is Norwalk Unclaimed Property

Unclaimed property is money that owners forgot. It is not real estate. It includes bank accounts that sit idle. It includes uncashed checks and insurance proceeds. Stocks and bonds count too. Utility deposits and refunds are common. Virtual currency is now covered under state law.

Property becomes unclaimed when owners lose contact with holders. This means no activity for three to five years. Banks must try to reach owners first. They send letters to last known addresses. If owners do not respond, funds go to the state.

Common types of unclaimed money in Norwalk include:

- Inactive savings and checking accounts

- Uncashed payroll and refund checks

- Forgotten utility deposits

- Inactive stocks and bonds

- Life insurance policy proceeds

The state holds these funds in trust. You can claim your money at any time. There is no deadline. Property from decades ago still waits for rightful owners in Norwalk.

Norwalk CT Big Match Automatic Returns

Connecticut started a new program in 2025. It is called CT Big Match. This program returns small amounts of unclaimed money automatically. You do not need to file a claim. The state matches property under $2,500 to verified owners. You get a letter first. Then a check arrives six to eight weeks later.

The program matches your name to your current address. The Treasurer checks your identity through state records. If you qualify, the process is simple. You wait for the mail. The check comes to your door. This saves time. It reduces paperwork. It gets money back to Norwalk residents faster.

If you get a check from the Connecticut Treasurer, do not throw it away. Call 1-800-833-7318 if you have questions. Staff can verify the check is real. This is a free service. You earned this money. The state wants to return it to Norwalk residents.

How to Claim Norwalk Unclaimed Money

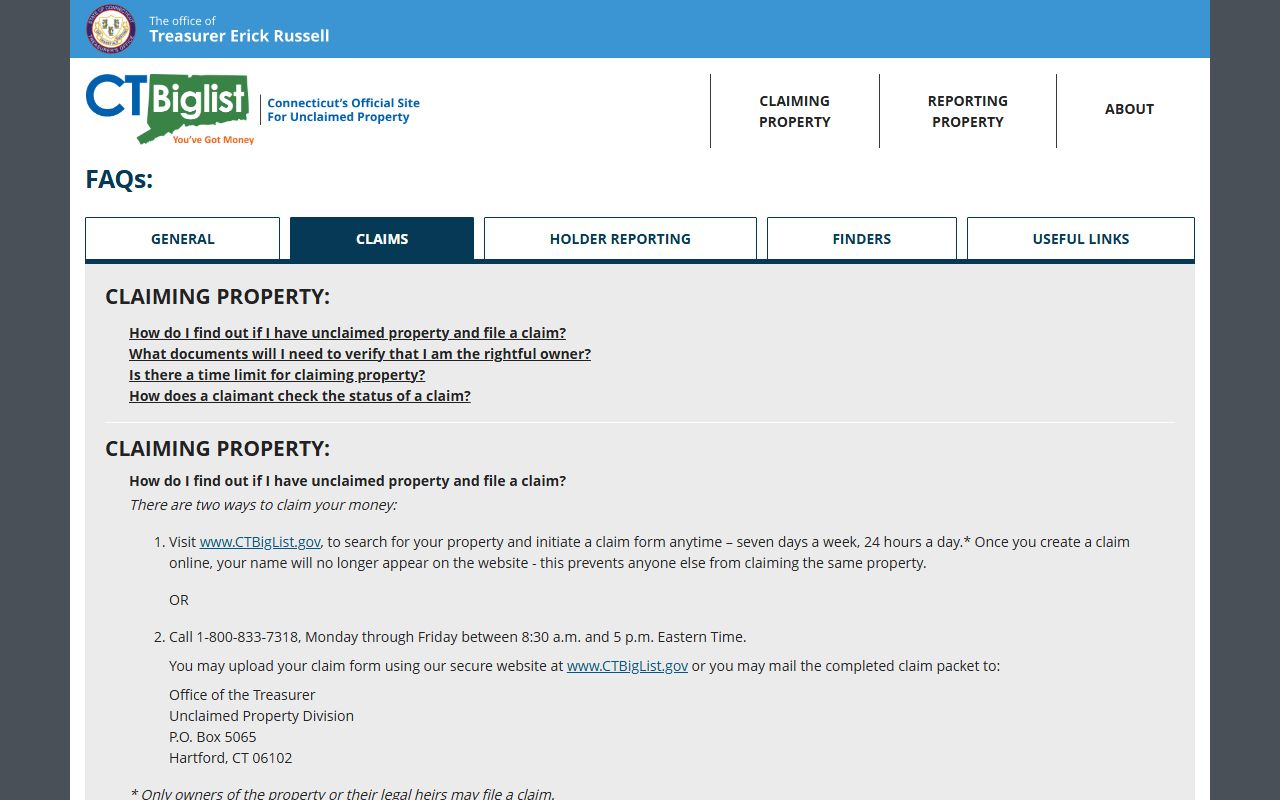

Filing a claim is easy. Start at ctbiglist.gov. Search for your name. Click on any property that is yours. Follow the prompts to start your claim. You will need proof of identity. This includes a photo ID and Social Security number. You may need proof of address or ownership papers.

Claims can be filed online. This is the fastest way. You upload documents through the secure portal. You can also mail your claim. Send it to PO Box 5065, Hartford, CT 06102. Include the claim form and copies of your documents. Keep originals for your records.

Note: Always use the official CT Big List website to file claims for unclaimed money in Norwalk.

The Treasurer has ninety days to review your claim under Connecticut General Statutes Section 3-70a. Most claims process faster. You can check your claim status online. Use the Claim ID from your form. Enter it on the Check Claim Status page. You will see updates as your claim moves through review.

Once approved, you receive your money. There are no fees. The state does not charge for this service. Do not pay any company that offers to find your unclaimed property for a fee. You can do this yourself for free.

Norwalk City Finance Contacts

The City of Norwalk has staff who can help with local questions. The Chief Financial Officer is Jared Schmitt. He can be reached at 203-854-7870 or jschmitt@norwalkct.gov. The Accounting and Treasury office is at 203-854-7715. The Tax Collector is at 203-854-7731.

City Hall is at 125 East Avenue, Norwalk, CT 06851. The fax number is 203-854-7848. Hours are Monday through Friday, 8:30 am to 5:00 pm. These staff can answer questions about local tax issues. They can also point you to state resources for unclaimed money.

The city website at norwalkct.gov has forms and contact info. You can find tax payment options online. You can also find information about city services. For unclaimed money, the state database is your best resource.

Documents Needed for Norwalk Unclaimed Property Claims

You must prove you are the rightful owner. The state requires specific papers. A signed claim form starts the process. You need a photo ID. This can be a driver's license or passport. You need to verify your Social Security number. A Social Security card or tax document works.

Proof of address helps your claim. Bring a utility bill or bank statement. The address should match the property records. If you moved, bring proof of your old address. This connects you to the unclaimed funds. Some claims need more proof. You may need a tax return or original check.

Heirs can claim property too. You need proof the owner died. A death certificate works. You need proof you are the legal heir. This might be a will or court order. The state works with heirs to return family money to Norwalk residents.

Norwalk Unclaimed Property Laws

Connecticut law governs all unclaimed property in Norwalk. The main laws are in Chapter 32 of the General Statutes. These laws protect your rights. They ensure holders report property properly. They give you a clear path to claim what is yours.

Section 3-56 defines unclaimed property terms. Section 3-57a sets dormancy periods. Bank accounts become unclaimed after three years. Safe deposit boxes have a five-year period. Section 3-65a requires holders to notify owners before reporting.

Virtual currency is covered under Section 3-57b. Wages become unclaimed after one year per Section 3-60b. Utility deposits share the same one-year rule. Holder reports are due March 31 each year.

Contact Connecticut About Norwalk Unclaimed Money

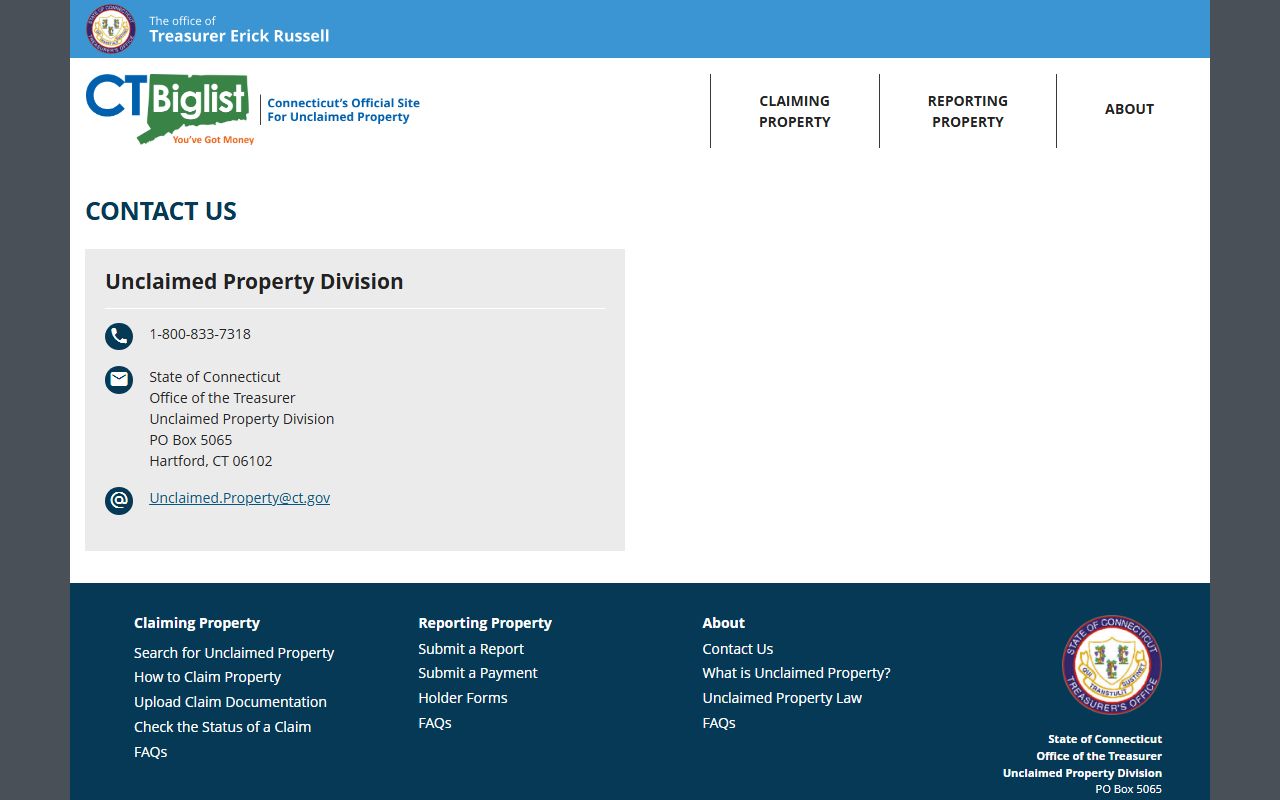

The Unclaimed Property Division can help Norwalk residents. You can call toll-free at 1-800-833-7318. Staff answer calls Monday through Friday. Hours are 8:30 AM to 5:00 PM Eastern Time. They can search for you over the phone. They can answer questions about claims.

Email works too. Send questions to Unclaimed.Property@ct.gov. Include your name and phone number. Describe what you need. Staff typically respond within a few business days.

Note: Always contact the state directly for questions about unclaimed money claims in Norwalk.

You can write to the office. The mailing address is Office of the State Treasurer, Unclaimed Property Division, PO Box 5065, Hartford, CT 06102. Send claim forms and documents here. Use certified mail for important papers. The main State Treasurer office is at 165 Capitol Avenue, 2nd Floor, Hartford, CT 06106.

Preventing Unclaimed Property in Norwalk

You can take steps to keep your money from becoming unclaimed. Keep good financial records. Know where your accounts are. Cash all checks promptly. Do not let checks sit in drawers.

Stay in touch with your banks. Contact them at least once a year. Update your address when you move. Tell every bank and company where you do business. Check your accounts regularly. Look for statements and notices.

Tell family members about your accounts. They should know where to find your records. This helps if something happens to you. Planning prevents property from becoming lost in Norwalk.

Fairfield County Unclaimed Money

Norwalk is in Fairfield County. All Fairfield County residents use the same state database to search for unclaimed money. The county includes cities like Bridgeport, Stamford, and Norwalk. For more information about unclaimed property in the region, visit the Fairfield County page.